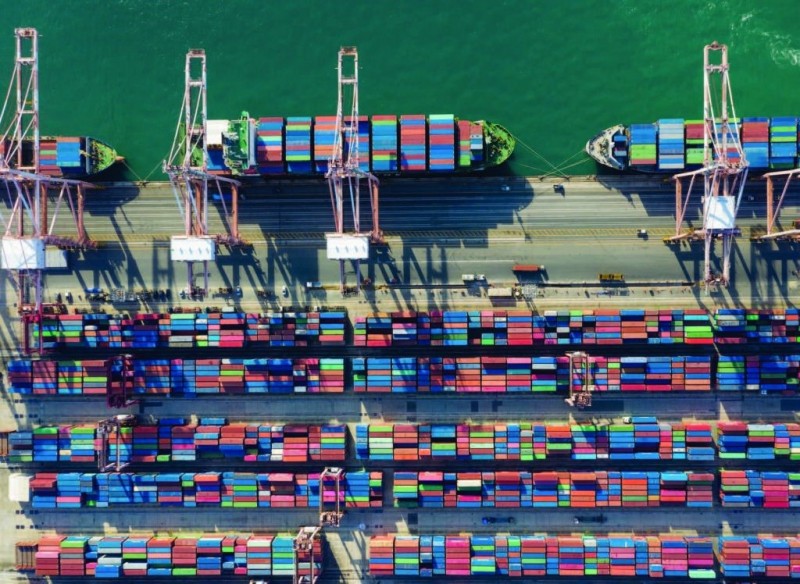

THE supply chain bottlenecks, network disruptions and operational contingencies and the economic damage caused by the Covid-19 placed shipping and port logistics in the spotlight in 2021.

When the Ever Given megaship blocked traffic in the Suez Canal for almost a week in March, it triggered a new surge in container spot freight rates. Shipping rates are a major component of trade costs.

A survey by the Malaysian National Shippers’ Council (MNSC) in October showed sea freight is now at an all-time high, having increased between 100% and 700% above pre-pandemic levels.

Chairman Datuk Andy Seo said this has led to higher transportation costs, causing companies to make transportdriven adjustments in their supply chain strategies.

“In addition to the increase of sea freight rates, shippers are also forced to bear other logistics costs such as the warehousing, forwarding, haulage and landside charges which have increased in parallel to the freight rates.

“This notable impact on the entire supply chain and the burden of high cost has been passed on to the consumers while negatively affecting export competitiveness,” he told The Malaysian Reserve (TMR) recently.

E-commerce, which accelerated during the Covid-19 pandemic, has transformed consumer shopping habits and spending patterns and is driving demand for distribution facilities and warehousing that are digitally enabled and offer value-added services.

This segment presents new business opportunities for shipping and ports.

Universiti Malaysia Terengganu senior lecturer of Faculty of Maritime Studies Dr Jagan Jeevan believed if seaports want to improve their competitiveness, they have to transform their operation from being purely volume-based to value-added service-based.

He said port operators need to explore the unique services they can provide to cargo clients such as rebranding, relabelling, repacking, free storage, inland mobility services and much more.

This is crucial to embark on a new dimension of seaport operation and remain ever competitive.

“Secondly, the transformation of seaport activities from logistics norm towards geologistics norm also can be emphasised. This new concept has been proposed to channel the new market for seaports towards inland rather than focusing much on ocean activities.

“This geologistics concept pushes seaports to cooperate with inland ports to explore new markets in particular regions, districts, municipalities or villages for the benefits of mankind,” he told TMR.

Jeevan said this paradigm shift will create a new export market for seaports and reduce the volume of imports which will eventually expand the progress of GDP.

He believes Malaysian seaports are at the exploration and discovery phases for the IR4.0 implementation.

“The advancement of Malaysian seaports in the perspective of IR4.0 is still lacking and an immediate transformation in maritime policy and technology is required to ensure the seaports are remaining competitive in the disruptive era,” he said.

That said, Malaysian ports were listed among the most efficient ports last year.

Transport Minister Datuk Seri Dr Wee Ka Siong has stated this turnaround is b etter than many regional competitors at a time when 77% of ports — according to a Bloomberg report — were experiencing abnormally long times of turnaround.

Dubbed “time of turnaround”, the matrix captures the duration taken by the ports to handle incoming vessels as well as the disembarkation and distribution of goods.

Source: https://themalaysianreserve.com/2022/01/11/e-commerce-technology-to-transform-demand-on-port-services/