PETALING JAYA: Bank Negara’s move to adjust downward the lower end of its growth projection for 2021 indicates that risks remain tilted towards the downside for the Malaysian economy, said economists.

Despite signs of gradual recovery, the national economy continues to see risks from a resurgence in Covid-19 cases and the relevant containment measures, delays in vaccination timelines, a shock in domestic commodity production as well as heightened financial market volatility.

In its latest annual report, the central bank reduced its 2021 gross domestic product (GDP) growth forecast to 6%-7.5% as compared to 6.5%-7.5% previously. However, it is noteworthy that Bank Negara is relatively more optimistic on the economic outlook compared to economists’ forecasts.

The central bank, in its assessment, had assumed international and inter-state borders to remain closed till year-end. It also assumed the huge savings accumulated by households and businesses over 2020, largely due to the loan moratorium and overall savings from lesser expenditure, would not be used for consumption in 2021.

CGS-CIMB Research, which expects a 5.7% GDP growth this year, said it has a lower projection due to its more conservative outlook on private consumption and services recovery.

“Much of the deviation rests on the magnitude of the second quarter of 2021 rebound off a very depressed base last year during the first round of the movement control order, particularly in private consumption and services, where we view the pace of vaccinations and consequently normalisation of consumer behaviour in the second half of 2021 as being more uncertain than Bank Negara forecasters, who point to potential upside surprises in the form of pent-up demand and precautionary savings.

“Moreover, stimulus tailwinds are likely to diminish as the country shifts to more targeted movement controls. While Bank Negara suggests income and labour market recovery to be counter-balances, these may be offset by the elevated unemployment rate and hiring frictions, in our view, ” it said in a note yesterday.

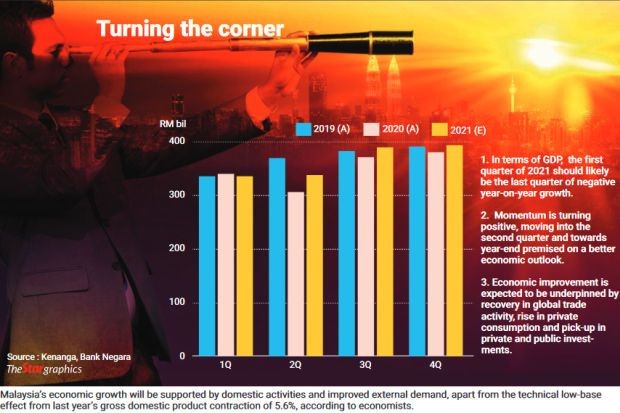

Commenting on the adjustment of GDP forecast by Bank Negara, AmBank Research said it shows a “wider growth outlook”, although it reaffirms an expected strong economic rebound in 2021. The research house added that the economic growth would be supported by domestic activities and improved external demand, apart from the technical low-base effect due to last year’s GDP contraction of 5.6%.

“Our GDP projection for 2021 has been revised to 5.5% – 6%. A key growth area in 2021 will be public investment, projected to expand by 15.2% as compared to a contraction of 21.4% in 2020.

“Budget 2021, various stimulus measures, digital infrastructure and connectivity; and continuation of large-scale infrastructure projects will provide the necessary uplift for investment and growth. Public consumption would strengthen by 4.4% from the Covid-19-related expenditure, ” it said.

Meanwhile, Kenanga Research pointed out that economic improvement in 2021 is expected to be underpinned by a recovery in global trade activity, rise in private consumption and pick-up in private and public investments.

“Bank Negara expects a broad-based recovery across the demand and supply side, led by a rebound in private sector expenditure and the services sector. This is in line with our view of a continued global economic recovery bolstered by the technology upcycle, vaccination drive, less stringent movement restrictions and extended fiscal measures, ” it said.

Kenanga Research expects the Malaysian economy to grow by 4.5% as compared to Bank Negara’s projection of 6% to 7.5%. In contrast to the central bank, Kenanga Research projects lower growth for all economic sectors in 2021, except for mining.

The slightly higher growth projection for the mining sector at 3.5%, in comparison to Bank Negara’s 3.1% forecast, is due to anticipation of gradual pickup in global crude oil demand and an increasingly higher supply drawdown rate.

Source : https://www.thestar.com.my/business/business-news/2021/04/02/recovery-with-risks