Image credit: odisi

PETALING JAYA: Anyone down to his last ringgit may yet see some relief. However, this “instant gratification” may come at a high cost.

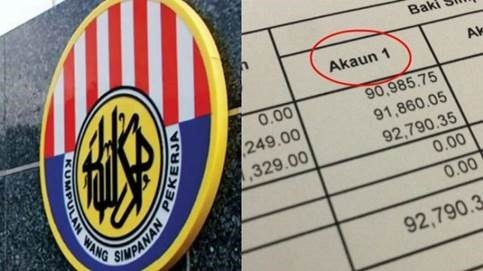

The government has agreed to look into the possibility of allowing Employees Provident Fund (EPF) contributors to withdraw from Account 1 of their savings.

If it goes through, this will be the first time that any contributor will have early access to the money that is otherwise reserved solely for his golden years.

However, the move will also deplete their retirement funds.

In an interview with Bernama and local TV stations on Tuesday, Prime Minister Tan Sri Muhyiddin Yassin said he had discussed the matter with the Finance Ministry, and the government is now examining the proposal further.

Views on the proposal have been sharply contrasting. Worker representatives have expressed support for the idea but businesses have warned that it would be detrimental not only to the individual EPF contributor’s future but to the country’s economic health as well.

In a front page report yesterday, theSun highlighted the arguments for and against the proposal as aired by the Malaysian Trades Union Congress (MTUC) and the SME Association of Malaysia.

MTUC president Datuk Abdul Halim Mansor said the chance to dip into their savings in Account 1 would give contributors a much needed lifeline, given that many of them are under severe financial stress as a result of job losses and pay cuts caused by the Covid-19 pandemic and the subsequent economic fallout.

However, SME Association president Datuk Michael Kang warned that it would be disastrous for the contributors and the country.

In the interview, Muhyiddin said the government would consider the possibility of providing access to Account 1 for those who have been retrenched, if they also meet “certain requirements”.

However, he also stressed that if there already are sufficient provisions in Budget 2021 to help Malaysians who are under financial stress, there would then be no need to withdraw from Account 1.

Finance Minister Tengku Zafrul Abdul Aziz will table Budget 2021 for debate in the Dewan Rakyat at 3pm tomorrow.

In April, the government eased the rules to allow contributors to withdraw up to RM500 a month from Account 2 of their EPF savings. Employees’ monthly contributions to their EPF savings was also reduced from 11% to 7% to give them additional cash in hand.

Another initiative was the i-Lestari, that allowed the withdrawal of up to RM6,000 from the same account.

Muhyiddin said close to 70% of contributors have already chosen to reduce their contributions to 7%, leading to an increase in disposable income nationwide by almost RM700 million.

He also expressed fears that contributors would not have enough savings left for their golden years if they are allowed to dip into Account 1.

“We will have to strike a balance between catering to the short-term needs and long-term financial security. We want to ensure that it will not jeopardise their retirement,” he said.

On the proposal to extend the moratorium on loan repayments, he said the matter has been discussed with Bank Negara Malaysia and the Association of Banks in Malaysia.

He said the government is now examining the proposal to determine the best way forward to help those in dire need of support.

Source: https://www.thesundaily.my/local/govt-agrees-to-explore-possibility-of-releasing-epf-funds-to-contributors-to-alleviate-financial-burden-YY4991724