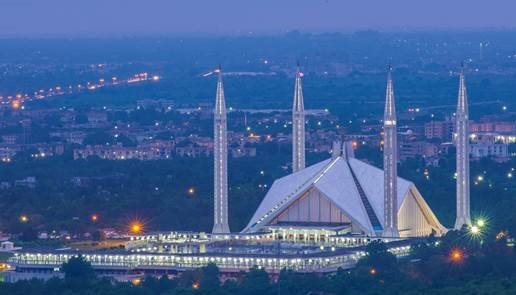

Image credit: Wikipedia

ISLAMABAD: The government on Wednesday enhanced loss coverage for small and medium enterprises (SMEs) taking concessionary loans to prevent workers’ layoff till September 2020.

The Economic Coordination Committee (ECC) of the cabinet approved the risk-sharing facility for the State Bank of Pakistan (SBP) refinance scheme to support employment and prevent layoff of workers during a meeting presided over by Adviser to the Prime Minister on Finance and Revenue Hafeez Shaikh.

The scheme supports provision of credit at concessional rate to businesses that commit not to lay off workers till September 2020. Earlier the cutoff date was 30 June, 2020.

The loss coverage for SME sector has been increased to 60 percent from the existing 40 percent to promote take-up at the smaller level of business.

“Under the new changes the borrowers having turnover up to Rs800 million can avail benefit of the scheme; earlier, for the eligibility of the scheme, the turnover limit was up to Rs2 billion,” the finance ministry said in a statement.

Last month, the government allocated Rs30 billion under a credit risk sharing facility for the banks spread over four years to share the burden of losses due to any bad loans in future. The ministry of finance and SBP introduced the mechanism to support bank lending to SMEs and small businesses to avail SBP’s refinance facility to support employment.

The ECC further approved Rs19.5 billion worth of technical supplementary grants for various government functionaries, including Rs3.2 billion for Pakistan International Airlines to discharge the obligations on account of markup against government-guaranteed loans, Rs25.2 million in favour of Pakistan Academy for Rural Development Peshawar for the current financial year, Rs1.3 billion to Pakistan Atomic Energy Commission to discharge its various liabilities, Rs235 million to Deputy Commissioner Islamabad for making payment of internal security duty allowance to troops of Pakistan Rangers (Punjab) deployed in Islamabad, Rs500 million to the ministry of information and broadcasting to meet the expenditure of media campaign on COVID-19, Rs100 million for National Disaster Management Authority (NDMA) for procuring equipment for locust control in Punjab, Rs7.9 billion to NDMA on account of procurement of emergency equipment through foreign mission in China, Rs4.5 billion for the capacity building of civil armed forces, Rs80 million for Competition Commission of Pakistan for different expenses, Rs100 million for the purchase of kerosene oil by Head Quarters Frontier Corps KP (North), Rs8.1 million for the Privatisation Division for employee related expenditure, Rs1.2 billion and Rs358.506 million for ministry of federal education and professional training for the award of scholarships to Afghan students.

ECC also granted approval for book value adjustment of overdue amount of loans amounting to Rs30.807 billion to Earth Quake Reconstruction and Rehabilitation Authority over and above its allocated development and non-development budget.

It also allowed, on the recommendation of the committee earlier constituted by the ECC, to convert two relent Chinese loans into government loans.

ECC also approved the handing over of Pakistan Machine Tool Factory to strategic plans division that would be loaned Rs500 million.

The federal government will pay all the liabilities accrued till the transfer of management control after partial settlement of liabilities of Rs1.78 billion.

Source: https://www.thenews.com.pk/print/674029-ecc-augments-loss-coverage-for-sme-loans-to-prevent-layoffs