PETALING JAYA: Brace for deeper economic contraction as the country heads into the third phase of the movement control order (MCO).

Experts have once again revised their growth forecast for 2020 downwards, following the government’s decision to extend the MCO by another two weeks until April 28.

The prolonged MCO means that most businesses face further losses due to the operational shutdown, and this would drag down local economic activities that were already severely impacted by the first two rounds of the MCO, which lasted for nearly a month.

CGS-CIMB Research said at least 50% of companies under the FBM KLCI - including banks - will see further earnings cuts.

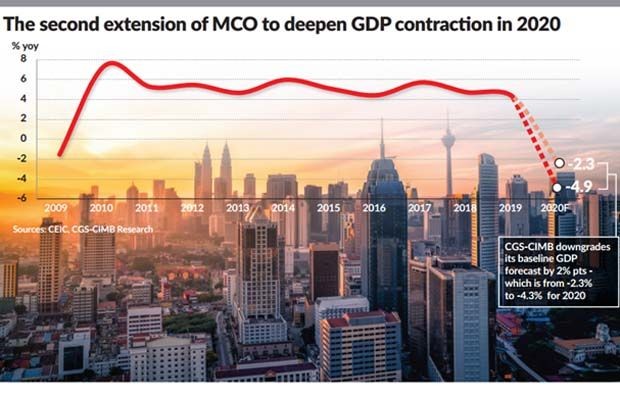

In a note issued yesterday, the research house said it has downgraded its new gross domestic product (GDP) forecast by two percentage points to -4.3% in 2020.

Previously, it had projected the GDP to decline by 2.3% this year. For comparison, the Malaysian economy grew by 4.3% in 2019, the weakest growth since 2009.

“The drag could have been worse – by up to 0.6 percentage points according to our calculations – but for the government’s directive that certain business operations would be allowed to resume in stages, which will help lift capacity utilisation slightly across the economy.

“A committee led by the Ministers of International Trade and Industry and Defence has been tasked with recommending a list of businesses, sectors or zones, that will be allowed to restart limited operations while in compliance with the MCO requirements, ” the research house said in a note yesterday.

Similar to CGS-CIMB Research, Hong Leong Investment Bank (HLIB) Research has also lowered its GDP forecast by two percentage points to 4%.

“This is premised on the assumption that there will be very limited reopening of economic activity from 40%-45% to 50%-55% of GDP over a very gradual pace, ” it said.

HLIB Research added that the Malaysian economy could experience a trough in the second quarter of 2020 due to the expected peak in Covid-19 infections.

This is expected to gradually improve towards the end of this year.

“We maintain our expectation for Bank Negara to reduce the overnight policy rate by 50 basis points (bps) in 2020, ” it said.

Meanwhile, MIDF Research has also slashed its growth forecast to 1% from 2.7% previously.

“Although we foresee the Malaysian economy continuing to expand in 2020, it will be significantly moderated. Besides the impact from the MCO, external trade performance will be another factor.

“More countries worldwide are imposing at least partial lockdowns. These restrictions will adversely affect private consumption and investment, along with external trade performance, ” it said.

As a result, MIDF Research foresees the economic data for the first half of 2020 (1H20) to be more precarious than before.

However, it expects a recovery in 2H20, as fears from Covid-19 wane.

“The economic growth overall will be influenced by various internal and external factors, including disruption in global production and consumption following Covid-19, recession fears, global financial stability, the oil price war, inflationary pressure and the labour market performance.

“We remain cautious that if the pandemic lasts until the year-end, the economy will contract, ” it said.

For now, the consensus view is that the extended MCO in Malaysia will hit companies’ bottom lines hard.

In a note issued yesterday, UOBKayHian Malaysia Research has slashed its market earnings forecasts for 2020 and 2021 by 7.1% and 5.3% respectively since March 1.

“We fear that the prescription for the Covid-19 pandemic may have become toxic to the economy, with many SMEs at financial breakpoints.

“The pace of economic and consumption recovery will inevitably slow down, dampened by expected business closures and low reinvestment rates even after the pandemic is contained, ” it said.

Meanwhile, CGS-CIMB Research stated that the additional sectors that have been authorised by the government to operate during the second MCO extension will be able to limit their losses.

The sectors include selected construction projects, the machinery and equipment industry, as well as selected activities of auto players.

However, companies that are not allowed to operate will incur wider losses, as assistance from the government’s stimulus measures are insufficient to cover operating costs required to sustain the business over the next two weeks.

“The sectors least affected by the MCO extension would be telcos, utilities, plantations, gloves, and food and beverage players.

“Tourism-related sectors like gaming (casinos and numbers forecast operators), airlines, airports, theme park operators, entertainment outlets, property, construction and retailers, as well as manufacturers that are not allowed to operate will be the most vulnerable.

“Banks’ earnings are likely to be affected by further rate cuts (projecting another 75bps cut) and potential rise in credit costs, ” said CGS-CIMB Research.

Source : https://www.thestar.com.my/business/business-news/2020/04/14/third-phase-mco-contraction-seen