PETALING JAYA: RHB Research is advocating a beta-play strategy on big caps to track the global semiconductor and macroeconomic landscape, while being selective in the small-cap tech space.

Beta is a measure of a stock’s volatility in relation to the overall market.

The research house said this is due to the absence of a meaningful recovery for at least the next three to six months and potential earnings disappointment due to high expectations in financial year 2024 (FY24).

It added that while there are signs of bottoming, valuations are not appealing yet, given the high interest rate and yield environment.

The research house is maintaining its “neutral” call on the technology sector.

It said most semiconductor companies expect a better FY24, with a more meaningful recovery in the second half of next year.

“Potential opportunities from the China Plus One strategy and possible peaking of US interest rates may spur trading, further supported by the solid balance sheets and sturdy foreign exchange movement.”

On another note, the research house said, the keen interest in artificial intelligence (AI) in the country, will accelerate digital and cloud adoption in the public and private sectors, as well as elevate the status of high-tech regional cloud centres in line with the New Industrial Master Plan 2030.

The visit by US-based Nvidia Corp’s CEO and founder Jensen Huang to Malaysia last week also stirred interest in the technology sector.

Huang, who was visiting Malaysia for the first time, announced a collaboration with YTL Power to develop an AI infrastructure hub with excellence centres for AI learning, research, and cloud systems, all of which bodes well for the AI and technology sector as a whole.

During his visit, Huang also said Malaysia stands as a critical infrastructure hub in South-East Asia and features notable companies like YTL.

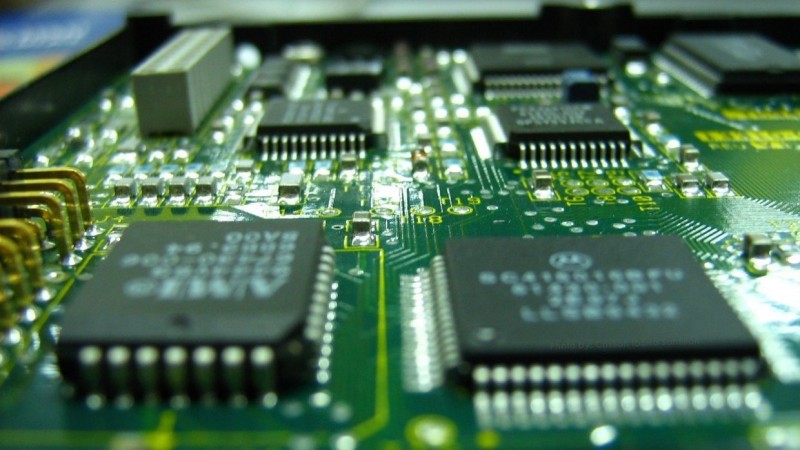

For semiconductor exposure, one of the brokerage’s top picks is Inari Amertron Bhd, given its relatively sticky earnings base and strong market liquidity.

Another is CTOS Digital Bhd, due to its stability in its domestic-focused business and growth prospects in its digital and fintech solutions.

Meanwhile, TA Research said it reiterated its “neutral” stance on the semiconductor sector.

“While the semiconductor industry is turning the corner, providers of outsourced semiconductor assembly and testing, including Malaysian Pacific Industries Bhd and Unisem (M) Bhd, have continued to echo cautiousness into the fourth quarter with near-term visibility clouded by uneven demand recovery across end-market segments and fluid customer forecasts, amid ongoing market uncertainty.

On another note, the brokerage said it has upgraded its recommendation on Inari Amertron Bhd from “hold” to “buy,” given the stock’s improved risk-reward potential following recent share-price weakness, adding that Inari’s new projects are progressing according to plan, with new packaging technology and budgeted capex on new plant expansions earmarked for future growth.

The investment holding company is principally engaged in the outsourced semiconductor assembly and test services and electronics manufacturing services industries through a number of subsidiaries.

“Our top pick is Inari Amertron, which we like for its growth prospects with catalysts from the 5G theme, traction in its customer-diversification efforts and above-industry-average profitability,” TA Research said.

Source: https://www.thestar.com.my/business/business-news/2023/12/13/tech-companies-set-to-turn-the-corner-next-year