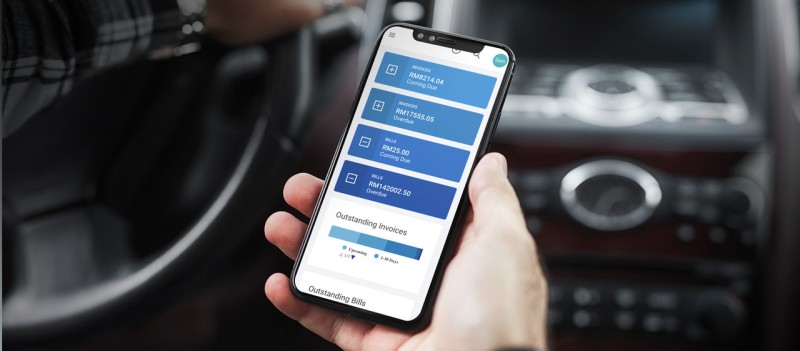

Malaysian small and medium enterprises (SMEs) can now access instant financing eligibility checks directly through their accounting platform, following a new integration between Funding Societies and cloud-based provider Bukku.

The collaboration, live since December 2023, enables Bukku users to receive pre-approved financing offers from Funding Societies using real-time financial data without uploading documents or going through traditional paperwork. To date, the system has facilitated RM1 million in financing for SMEs.

The tie-up comes as Malaysia prepares to expand e-invoicing requirements under the MyInvois system. Bukku’s compliance with these frameworks positions its users ahead of the regulatory curve, while the financing integration supports Bank Negara Malaysia’s push for inclusive SME funding.

The Instant Qualification feature is designed to simplify loan access for micro and underserved businesses, which represent over 97% of all enterprises in the country. One beneficiary, DNA Tech Digital Sdn Bhd, secured working capital through the feature to sustain operations and grow its client base.

Funding Societies and Bukku are now looking into deeper collaboration areas, including embedded invoice financing, shorter turnaround for pre-approvals and improved data-based assessments to lower interest rates.

The partnership also includes a cashback promotion valid until July 31, 2025, for eligible Bukku users who successfully obtain financing.

Source: https://www.businesstoday.com.my/2025/06/25/funding-societies-partners-bukku-to-speed-up-loan-approval-process-for-smes/