KUALA LUMPUR:: Bank Islam Malaysia Bhd marked a significant stride in its sustainable journey with the launch of IHSAN Financing for Business Resilience, Sustainability and Green Transition (IFiRST), unveiled at the inaugural Bank Islam Sustainability Conference 2025.

Bank Islam Group chief executive officer Datuk Mohd Muazzam Mohamed said that IFiRST is a tailored financing solution designed to empower businesses, particularly small and medium enterprises (SMEs) and mid-tier companies, in adopting more sustainable and resilient practices.

It provided equitable and accessible support, enabling businesses to actively participate in the transition to a low-carbon economy.

“This new financing solution reflects our bank’s commitment to a fair and inclusive transition across all segments of the economy.

“By enabling greener practices throughout the entire value chain, we are supporting not just large companies but also the smaller businesses and ecosystem partners that play a vital role in reducing carbon emissions.

“IFiRST strategically focuses on carbon-intensive sectors, incorporating access to facilities, such as Bank Negara Malaysia’s Low Carbon Transition Facility (LCTF). This integrated approach helps businesses overcome financial and operational barriers in their sustainability journey, ensuring that no stakeholder is left behind,” he said.

The launch of IFiRST further strengthens the bank’s leadership as a purpose-driven Islamic financial institution dedicated to embedding environmental, social and governance (ESG) principle into its core offerings.

Aligned with Shariah values and the bank’s long-term strategy, IFiRST creates shared value for customers, stakeholders and the environment, while enhancing risk management and unlocking new avenues for sustainable and responsible asset growth.

As of December 2024, Bank Islam has achieved 93% of its revised FY2025 target of RM28bil in sustainable finance and assets, demonstrating strong momentum and growing market confidence.

This progress is driven by impactful offerings, such as the Ihsan Sustainability Investment Account (ISIA), SME SMART Eco Financing Programme-i (ECO) and access to the LCTF.

Mohd Muazzam further added, “Bank Islam strives to be a strategic partner in assisting our customers to future-proof their businesses through advisory services, sustainable financing solutions and knowledge-sharing platforms.

“As industries accelerate their shift towards a low carbon future, Bank Islam plays a vital role in mobilising capital to empower corporates and businesses in adopting green technologies or solutions. These efforts will enhance economic resilience and support Malaysia in achieving its climate goals on schedule.

Looking ahead, the bank is set to implement its Climate Transition Plan, a strategic roadmap that will steer the bank towards achieving net zero emissions by 2050.

The plan will accelerate efforts to expand green and transition financing, while fostering partnerships with clients in high-impact sectors to drive the adoption of sustainable, low-carbon business models.

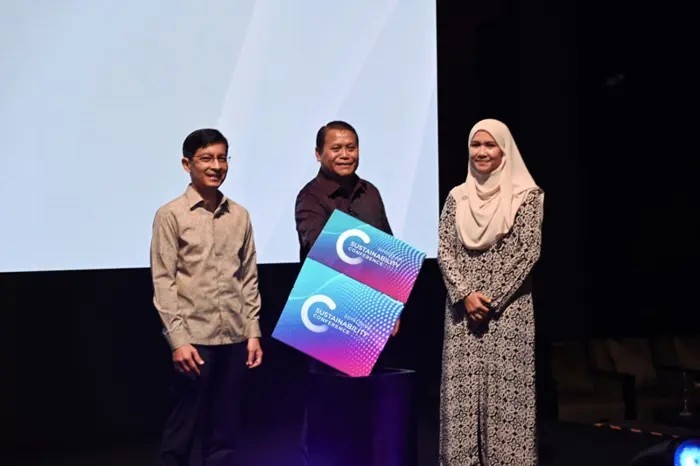

The Bank Islam Sustainability Conference 2025, themed “Accelerating Just Transition Towards a Nature-Positive Economy”, serves as a platform to reaffirm the bank’s commitment to advancing Malaysia’s low-carbon transition and ESG aspirations.

Economy Ministry secretary-general Datuk Nor Azmie Diron graced the conference. Also in attendance are industry leaders, policymakers and representatives from the financial sectors.

On the sidelines of the conference, Bank Islam also exchanged documents with Thoughts in Gear and Mastercard to strengthen its sustainability commitment and accelerate meaningful progress in the transition towards a low-carbon economy. Bank Islam has entered a strategic collaboration with Elopura Power Sdn Bhd, a subsidiary of Sabah Electricity Sdn Bhd.

Source: https://www.thestar.com.my/news/nation/2025/06/19/bank-islam-unveils-ifirst-for-smes-and-mid-tier-companies